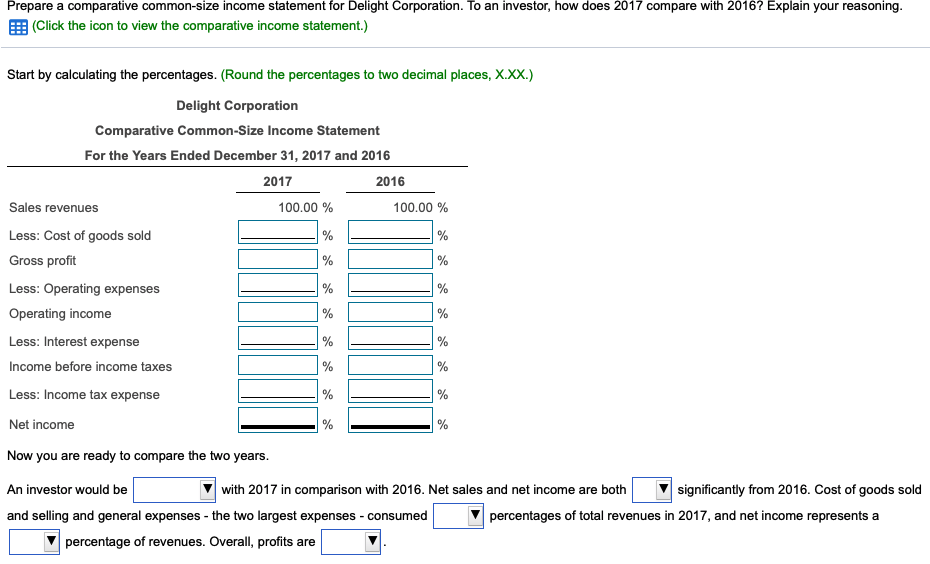

You can use it to see how your business stacks up percentage-wise with another business, even if that business is substantially larger. A Vertical Analysis of the Financial Statements of a company, in which the amount of individual items of a Balance Sheet or Statement of Profit & Loss are written is known as a Common-size Financial Statement. The percentages calculated by taking the respective common bases are then compared with the corresponding percentages of other periods, through which meaningful conclusions can be drawn. A Common-size Statement can be prepared for inter-firm and intra-firm comparisons or for Balance Sheet and Income Statement.

- For Synotech, Inc., approximately 51 cents of every sales dollar is used by cost of goods sold and 49 cents of every sales dollar is left in gross profit to cover remaining expenses.

- Generally speaking, a common-size financial statement is a type of analysis of an income statement that expresses each line of the statement as a percentage of sales.

- The common size percentages also help to show how each line item or component affects the financial position of the company.

- The cash that used to have to go toward supporting debt obligations now goes toward building an asset base, some of which (the 401(k)) may provide income in the future.

Format of Common-size Income Statement (Statement of Profit & Loss)

As her debt has become less significant, her ability to afford it has improved (to pay for its interest and repayment). Since her net income margin (and income) has grown, the only reason her return-on-asset ratio has decreased is because her assets have grown even faster than her income. A comparison of Alice’s comparative common size income statement financial statements shows the change over the decade, both in absolute dollar amounts and as a percentage (see Figure 3.22, Figure 3.23, and Figure 3.24). For the sake of simplicity, this example assumes that neither inflation nor deflation have significantly affected currency values during this period.

Difference Between Comparative Financial Statement and Common Size Financial Statement

One reason the cost of goods sold has gone up is that sales have gone up, but here is an important distinction. Thus we can see how Comparative Income Statement helps ascertain the changes of various components of expenses and identify the reason for changes that help the management in decision making in the future. ABC Limited has provided the following information about its two accounting periods, i.e., 2016 and 2017. For example, Alice has only two assets, and one—her car—provides 95 percent of her assets’ value. If something happened to her car, her assets would lose 95 percent of their value. Her asset value would be less exposed to risk if she had asset value from other assets to diversify the value invested in her car.

Common Size Financial Statements in Detail

Her income tax expense is a big use of her wages, but it is unavoidable or nondiscretionary. As Supreme Court Justice Oliver Wendell Holmes, Jr., said, “Taxes are what we pay for a civilized society.”U.S. Department of the Treasury, /education/faq/t…-society.shtml (accessed January 19, 2009). It is also valuable in framing financial decisions, pointing out which expenses have the largest impact on income and thus on the resources for making financial decisions. If Alice wanted more discretionary income to make more or different choices, she can easily see that reducing rent expense would have the most impact on freeing up some of her wages for another use.

What are the common items analyzed in a common size income statement?

Many computerized accounting systems automatically calculate common-size percentages on financial statements. In Common Size Financial Statements, each line item is presented as a percentage of a base figure, such as total revenue (for the income statement) or total assets (for the balance sheet). Comparative Financial Statements, as the name suggests, involve comparing financial data from multiple periods.

Common size horizontal analysis

A net profit margin is simply net income divided by sales, which is also a common-size analysis. In general, you can prepare a common-size income statement by going line-by-line and dividing each expense as a percentage of sales. Her income tax withholding and deductions have also increased, but she still has higher disposable income (take-home pay). Many of her living expenses have remained consistent; rent and entertainment have increased. Interest expense on her car loan has increased, but since she has paid off her student loan, that interest expense has been eliminated, so her total interest expense has decreased.

This analysis detects changes in a company’s performance and highlights trends. Cash may be used to purchase assets, so a negative cash flow may increase assets. Cash may be used to pay off debt, so a negative cash flow may decrease liabilities. Cash may be received when an asset is sold, so a decrease to assets may create positive cash flow. Cash may be received when money is borrowed, so an increase in liabilities may create a positive cash flow. Financial statements are valuable summaries of financial activities because they can organize information and make it easier and clearer to see and therefore to understand.

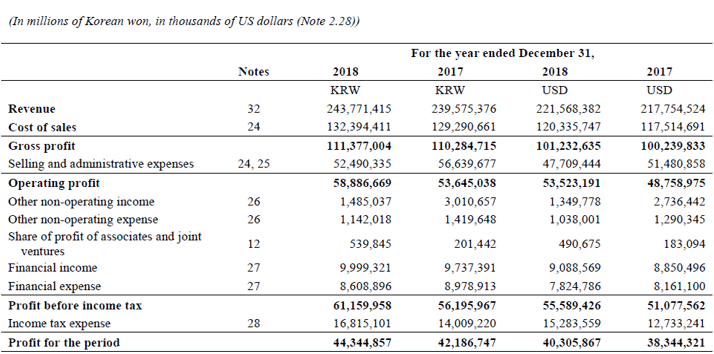

The ratios that involve net worth—return-on-net-worth and total debt—are negative for Alice, because she has negative net worth, as her debts are larger than her assets. She can see how much larger her debt is than her assets by looking at her debt-to-assets ratio. Although she has a lot of debt (relative to assets and to net worth), she can earn enough income to cover its cost or interest expense, as shown by the interest coverage ratio. Notice total current assets have increased $ 14.3 million, consisting largely of increases in cash, marketable securities, and other current assets despite a $63.0 million decrease in net receivables. Revenue, cost of goods sold, gross profit, operating expenses, operating income, and net income. One company may be willing to sacrifice margins for market share, which would tend to make overall sales larger at the expense of gross, operating, or net profit margins.